When we think of accounting mistakes, we often imagine big errors:

- Missing invoices

- Unpaid taxes

- Huge cash mismatches

But not all mistakes shout for attention. Some sit quietly in your books — unnoticed — and cause serious, long-term damage.

One of the biggest silent killers?

👉 Wrong ledger classification.

Let's break this down.

What is Ledger Classification?

In simple terms, ledger classification is how you categorize transactions in your accounting system.

Every payment, receipt, expense, or investment must be recorded under the right heading (ledger).

It's like sorting your wardrobe:

- Shirts with shirts

- Trousers with trousers

- Shoes with shoes

If you mix them up, you'll still have everything — but finding what you need becomes a mess.

Similarly, wrong classification in your books causes confusion, wrong reporting, and ultimately wrong decisions.

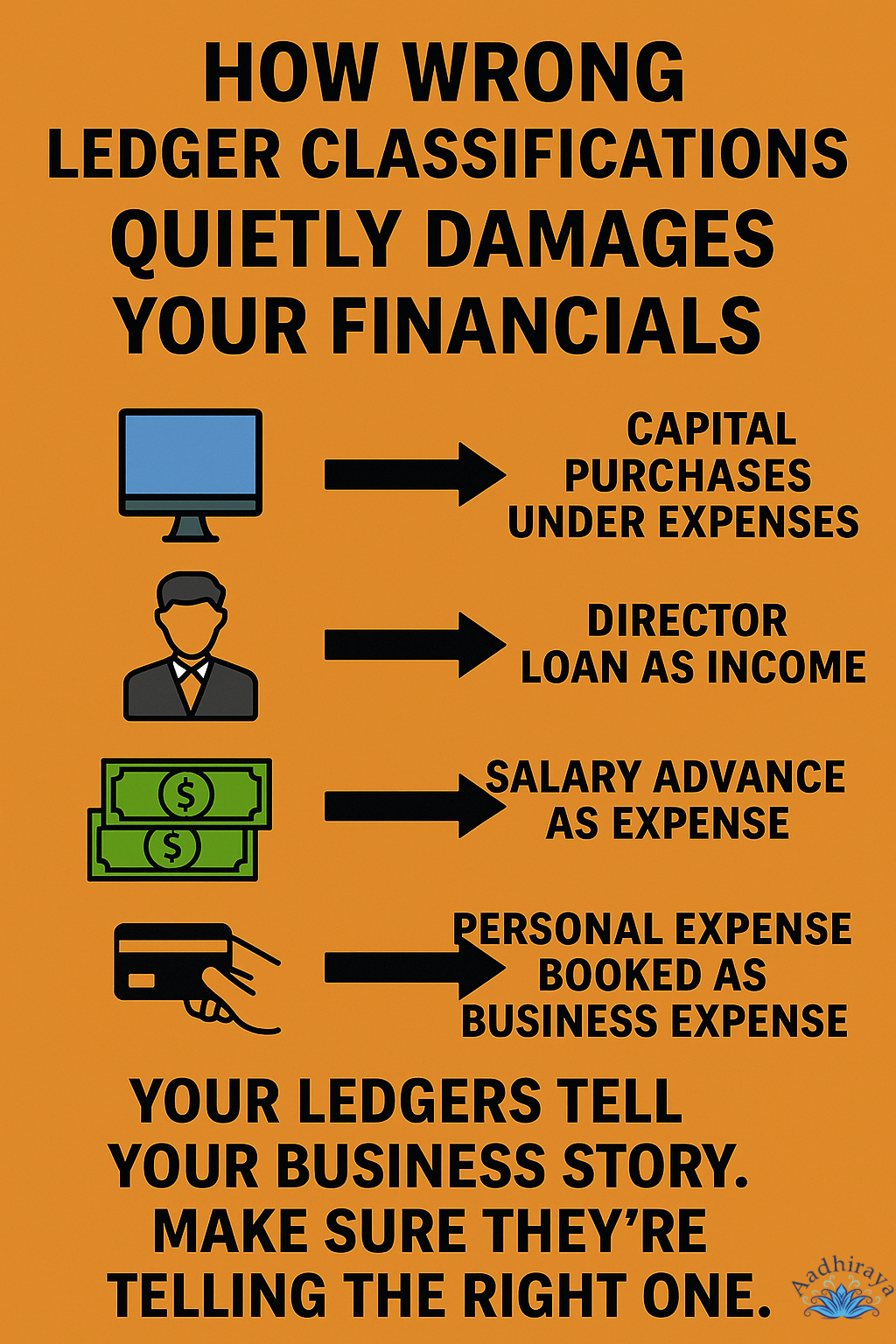

Real-Life Examples of Quiet Ledger Mistakes

- Recording capital purchases (like laptops or machinery) under "Office Expenses"

→ Immediate impact: Your Profit & Loss Account shows high expenses

→ Hidden impact: You miss claiming depreciation, misstate your profits, and confuse your tax filings. - Booking director loans as income

→ Immediate impact: Your revenues look inflated

→ Hidden impact: You may end up paying tax on what is not actually income. - Treating advance paid to employees as expense

→ Immediate impact: Your operating costs look higher than they really are

→ Hidden impact: It affects profit margins, financial ratios, and can cause compliance confusion. - Personal expenses booked as business expenses without adjustment

→ Immediate impact: You claim wrong deductions

→ Hidden impact: In case of scrutiny, penalties and disallowances follow.

🎯Why Ledger Classification Matters So Much

Wrong classification does more than mess up one report. It has a ripple effect:

| Issue | How it Hurts You |

|---|---|

| Tax Compliance | Wrong deductions or missed depreciation lead to wrong tax computation and penalties |

| Loan Applications | Banks rely on financial ratios; wrong profits or expenses can kill your eligibility |

| Investor Confidence | Clean books = credible business. Messy ledgers = risk in the eyes of investors |

| Internal Decision Making | Bad numbers lead to wrong business strategies and cash flow plans |

| Audit Delays | Auditors will question wrong ledgers — delaying report finalization and increasing costs |

🛠 How to Fix Ledger Classification Errors

👉 Define Ledger Groups Clearly

Create a simple chart: Fixed Assets, Income, Expense, Loans, Reimbursements, etc.

👉 Educate Your Team

Ensure whoever is doing entries understands the difference between an asset, an expense, and a liability.

👉 Do Monthly Ledger Reviews

Don't wait till year-end. Review and clean up misclassifications every month or quarter.

👉 Seek Professional Oversight

Even if you manage your own accounts, get an accounting professional to review your ledgers at least once or twice a year.

👉 Use Smart Accounting Software Setup

Ensure your software is configured properly with correct ledger groups from the start.

Your ledgers are not just for compliance. They tell your business story — to banks, investors, auditors, and future partners.

If your story is messy or inaccurate, you lose trust, money, and opportunities.

Get your ledger classification right. Your financial future depends on it.