You've spent months recording every invoice, every expense, every payment. So when your Chartered Accountant (CA) says, "Your books aren't ready for audit," it feels like a punch to all your hard work. But here's the thing:

Recording everything ≠ Audit-ready books.

Let's explore why - and how you can get truly audit-ready.

✅ Recording ≠ Audit-Readiness

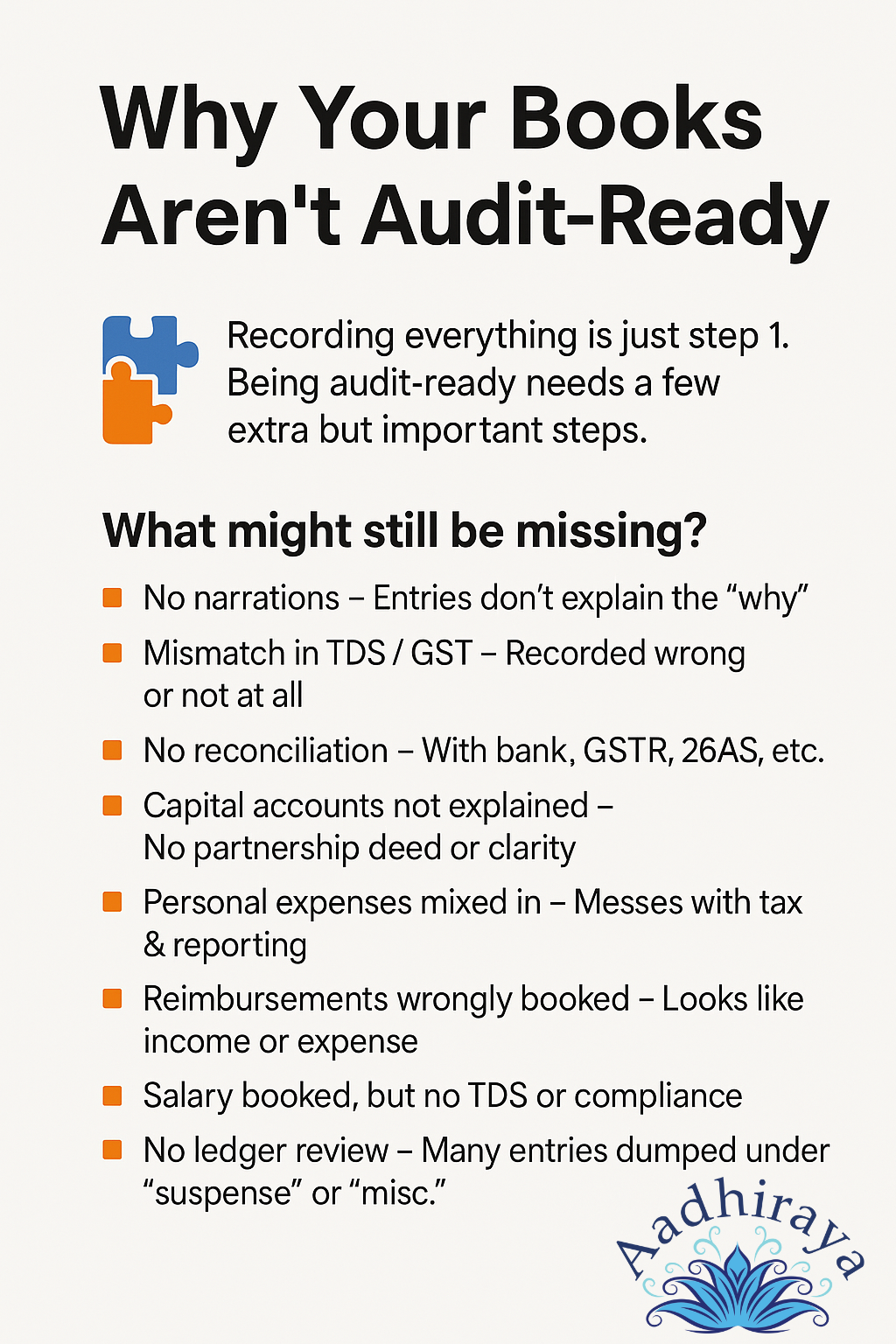

Recording data is just Step 1 in the accounting process. It's necessary, but not sufficient.

Think of it this way:

Recording is like stuffing your closet with clothes.

Audit-readiness is when everything is washed, ironed, color-coded, and neatly arranged.

Your auditor doesn't want clutter.

They want clarity.

🔍 Common Reasons Why Your Books Are Not Audit-Ready

Even with complete data, here are eight key red flags that can stop your CA from moving forward:

1. Missing Narrations

You've entered all your journal entries - great!

But without narrations, there's no context. The auditor won't understand why the transaction exists unless they ask you.

Narrations save time and explain intent.

2. TDS and GST Not Accounted Properly

You may have recorded payments, but:

- Was TDS deducted and shown in the books?

- Was GST input properly claimed?

- Was your GST reconciled with GSTR-2A?

Incorrect or missing tax treatment = audit delays and potential penalties.

3. Bank Books Not Reconciled with Statements & 26AS

Just because your books "tally" doesn't mean they're correct.

Ask yourself:

- Have you reconciled the bank books with actual bank statements?

- Is your income matched with Form 26AS?

Discrepancies here are a red flag for auditors.

4. Missing Supporting Documents

Even the cleanest entry needs proof.

Auditors may ask for:

- Purchase invoices

- Contracts for services

- Partnership deed for capital contributions

If these are missing, explanations won't cut it.

5. Personal Expenses Mixed with Business

Used your business card for a personal dinner?

That's okay if it's marked and adjusted correctly.

Otherwise, it distorts your profit and attracts unwanted scrutiny.

6. Salary Entries Not Followed by Compliance

You've recorded salaries, but:

- Was TDS deducted and paid?

- Are payslips in place?

- Is ESI/PF compliance maintained?

Book entries without statutory support can backfire during audit.

7. Cash Book Is in Negative

Did the owner pay for expenses from their pocket?

Then those need to be booked as capital contribution or loan.

Negative cash balances often signal:

- Direct booking without support

- Unrecorded cash sales

- Errors in cash handling

8. Suspense Accounts or Misclassified Ledgers

Too many entries under:

- "Miscellaneous"

- "Others"

- "Suspense"?

This tells the auditor: "We don't know what this is."

And that's never a good message.

📌 So, What Does It Mean to Be Audit-Ready?

Audit readiness goes beyond tallying books.

It means your accounts are:

- ✅ Accurate and clean

- ✅ Compliant with statutory guidelines

- ✅ Backed by documents

- ✅ Clear in logic ("why" for every "what")

- ✅ Structured for easy review

👩💼 The Solution: Go Beyond Data Entry

Data entry gets you started. But to finish strong, you need:

- ✔️ Review and cleanup of books

- ✔️ Reconciliation of bank, 26AS, GST

- ✔️ Clear narrations and classification

- ✔️ Proper tax treatments

- ✔️ Documentation

- ✔️ Expert review before audit

🙋 Need Help Getting Audit-Ready?

If you're a business owner unsure whether your books can pass an audit, I offer audit-prep reviews to clean things up — so you can be confident and compliant.

📩 Want a free Audit-Readiness Checklist? Drop an email to aadhirayamcs@gmail.com with subject "Audit-Readiness Checklist", and I'll send it right to your inbox.

🔁 Share this with a friend who's preparing for audit — it could save them weeks of confusion and penalties.